The start of 2022 has certainly been eventful. Between domestic, economic shifts and international geopolitical upheaval, the markets have experienced substantial volatility. The focus of this update is to provide you with a brief overview of what we see happening as the first quarter of 2022 continues to unfold.

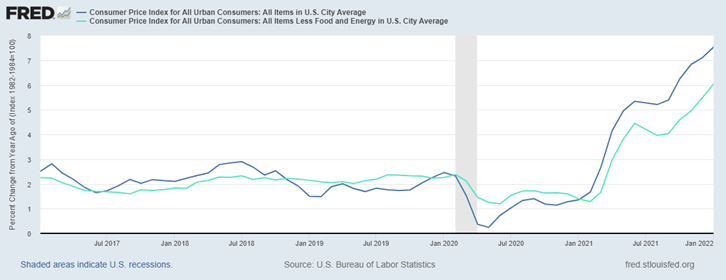

Inflation is becoming entrenched in the economy. A hot discussion topic for the first time in decades. Inflation is defined as the rate of increase in prices over a given period of time. The Consumer Price Index (CPI) is widely accepted as the leading measurement of inflation. The U.S. Bureau of Labor Statistics’ economic news release on February 10, 2022, stated that during the month of January, the inflationary rate has continued its climb to 7.5%[i]. Historically, U.S. markets have not experienced this extent of decreased purchasing power since February of 1982, as seen in the charts below.

Consumer Price Index (CPI): 5 Year Period

Consumer Price Index (CPI): 50 Year Period

With inflation comes a reaction from the Federal Reserve. During the fourth quarter of last year, the Federal Reserve signaled that it would begin tapering their purchasing of bonds by a systematic decrease of $30.0 billion per month. The tapering process is completed once the Federal Reserve is no longer buying bonds, thus, no longer stimulating the economy by adding to their balance sheet. The taper is estimated to conclude by the end of March 2022. The Federal Reserve has also indicated it is likely they will not raise the Federal Funds Rate until the taper is complete. As the following chart shows, this rate has been essentially zero for quite some time.

Effective Federal Funds Rate: 20 Year Period

Since the communication of the Federal Reserve’s intentions to taper their purchasing of bonds as well as an increase of the Federal Funds Rate, the market has reacted. Initially, the market expectations around the increase of the Federal Funds Rate was to be accomplished through four to six periodic increases of 25 bps between now and year end. Most recently, expectations shifted due to indications that the Fed may increase by a margin of 50 bps come March. As inflation established itself as a material concern of the Federal Reserve, the market proceeded to yield higher and higher interest rates. The expectations of rising Federal Funds rates as well as increasing market interest rates have significantly contributed to the decline of growth stocks. Growth stocks as a whole returned a negative 11.28%[i] in the month of January 2022. [ii]

On the geopolitical front, as you know by now, Russia invaded Ukraine this past Wednesday evening with the stated purpose of “demilitarizing” Ukraine. The underlying purpose seems to be occupying Ukraine as a portion of President Putin’s overall strategy of re-uniting the old USSR. NATO and the rest of the Western Nations have unanimously responded with significant economic sanctions.

What is interesting is that with the geopolitical upheaval in Europe, the likelihood of a 50 bps increase of the Federal Funds Rate in March has decreased. The market now appears to anticipate a reversion to the initial increase of 25 bps. Following the news of Russia’s invasion of Ukraine, evidence of these shifting expectations emerged in yesterday’s market performance. On February 24th, the market opened substantially lower and then ended substantially higher. The market rewarded equities for the probability that interest rates are more likely to rise at a lesser rate.

With all of this market turbulence, now is the time to remain invested and well diversified. While our short-term indicators are negative, our longer-term indicators remain positive. The recent portfolio adjustments made over the last few months are performing well and we are pleased with the current structure of the portfolio.

We hope your 2022 is off to a great start. Should anything covered in this email bring questions to mind, we are certainly happy to schedule a call with you to discuss in more detail.

[i] https://www.morningstar.com

[ii] https://www.federalreserve.gov/newsevents/pressreleases/monetary20211215a.htm